The Fusaka Upgrade: Why Financial Institutions Should Pay Attention

As Ethereum prepares for the Fusaka upgrade, financial institutions should understand the impact of these siificant changes before the upgrade and plan accordingly. The Fusaka upgrade aims to enhance Ethereum’s network performance and cost efficiency, but it could introduce operational risk if the upgrade doesn’t go as planned.

What’s different about the Fusaka Fork?

Unlike most Ethereum upgrades, which typically involve a single hard fork, Fusaka consists of three sequential upgrade events:

- December 3, 2025 at 21:49:11 UTC – Mainnet hard fork

- December 9, 2025 at 14:21:11 UTC – BPO1 (Blob capacity increase)

- January 7, 2026 at 01:01:11 UTC – BPO2 (Further blob capacity increase)

Each upgrade depends on the successful execution of the previous one. If validator nodes fail to upgrade on time at any stage, the blockchain could split, threatening transaction finality and requiring possible reconciliation across custody, asset management, or payment operations.

What's Changing

The Fusaka upgrade bundles 12 Ethereum Improvement Proposals (EIPs) designed to increase transaction and rollup capacity, reduce costs, and lay the groundwork for future enhancements such as sharding and parallel transaction processing.

The most significant changes are:

- PeerDAS (EIP-7594):

PeerDAS enables nodes to verify Layer 2 (L2) data availability, without downloading all blob data, using peer-to-peer data sampling. This dramatically improves scalability while preserving security, which is critical as L2 volume grows.

- Blob Parameter Only (BPO) Forks (EIP-7892):

BPO forks allow Ethereum to adjust blob capacity per block dynamically. Since blobs carry L2 rollup data, increasing capacity directly boosts L2 throughput without requiring major hard forks for each adjustment. BPO1 (December 9) increases the target from 6 to 10 blobs and the maximum from 9 to 15 blobs per block. BPO2 (January 7) further increases these to 14 and 21, respectively.

- Transaction Gas Cap (EIP-7825)

Individual transaction limit of up to 16.7M gas (2^24), preventing any single transaction from consuming an entire block. This protects against DoS attacks, improves network stability, enables predictable transaction costs, and enables future parallel transaction processing.

Note: Most standard transactions use far less than 16M gas and are unaffected. Institutions deploying complex smart contracts or batch operations should verify their transactions remain below this threshold on testnets before December 3.

- Gas Limit Increase (EIP-7935)

Ethereum's default gas limit rises from 36M to 60M per block - a 67% increase that directly expands L1 transaction capacity. This enables more transactions per block and reduces congestion during high-demand periods.

What Financial Institutions Should Monitor

Before December 3:

- Verify that infrastructure providers are running upgrade-compatible clients

- Monitoring Ethereum network-wide client adoption rates

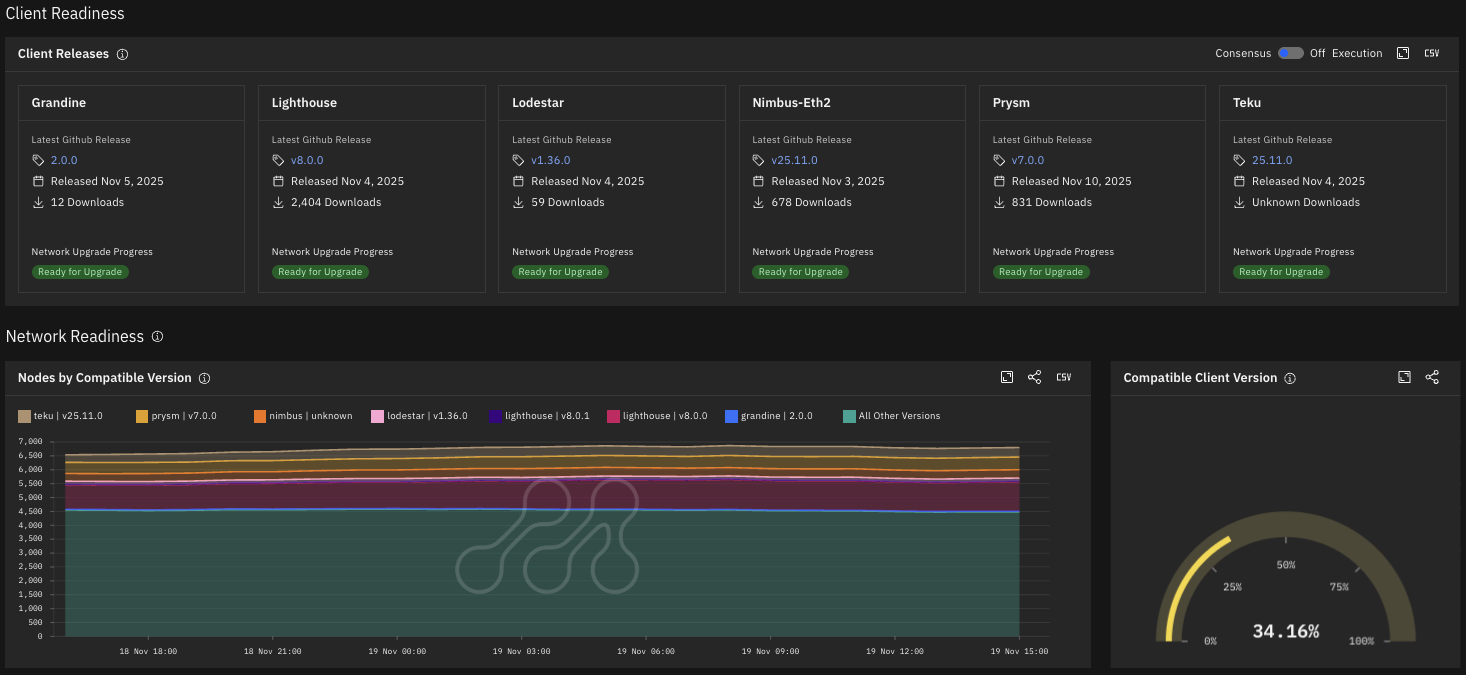

Metrika tracks new client releases and node upgrade adoption rates across the network, serving as a leading indicator of network readiness. As of November 19, 34.16% of the monitored nodes are running compatible clients. The platform provides adoption trends over time and breakdown by consensus client implementation (Lighthouse, Prysm, Teku, Lodestar, etc.)

Client Readiness Metrics for the Ethereum Fusaka Upgrade Source: Metrika Platform (Time Zone UTC)

During each transition:

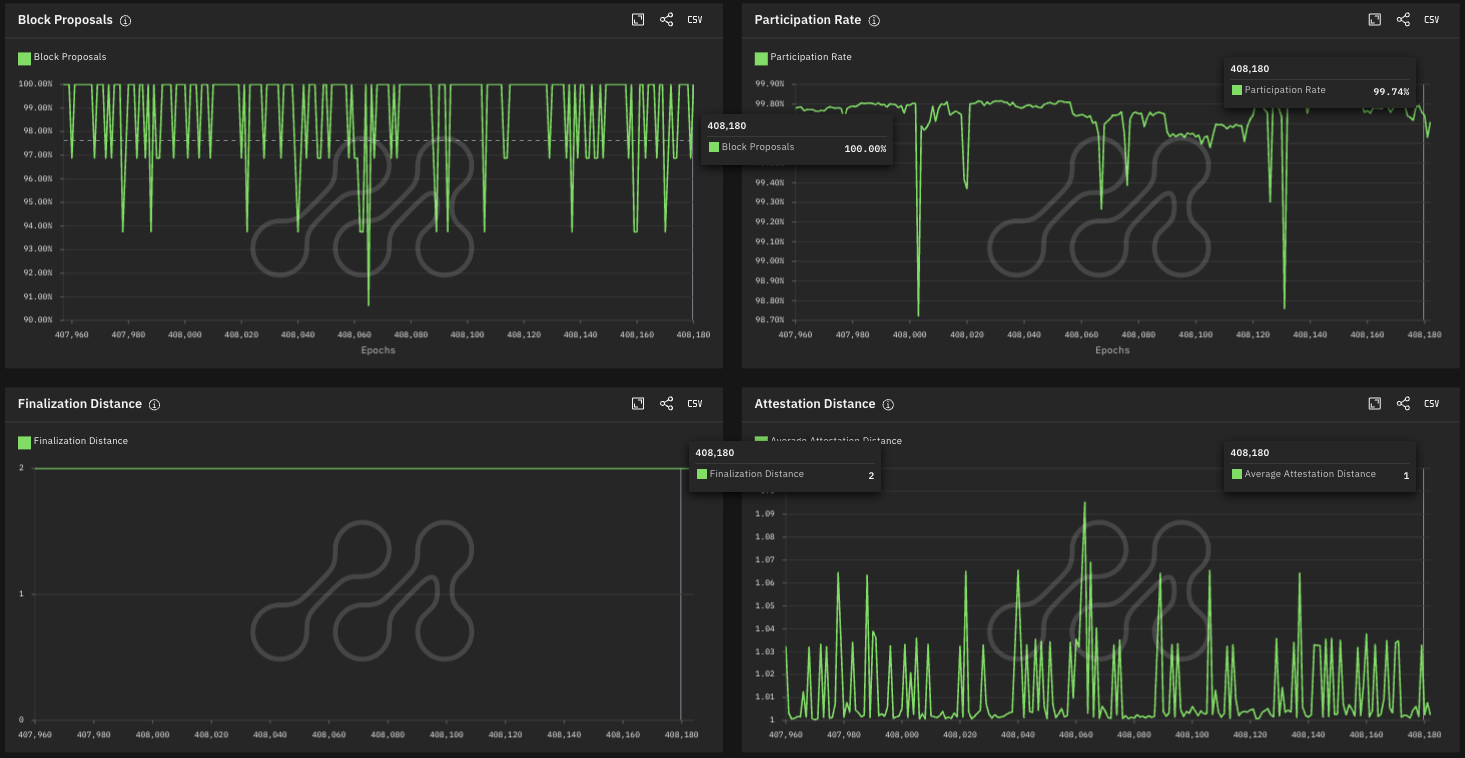

- Monitor block finalization in real-time - ensure the network has reached stable consensus (typically 2 epochs, approximately 13 minutes) before resuming high-value operations

- Track attestation rates and block proposal success metrics

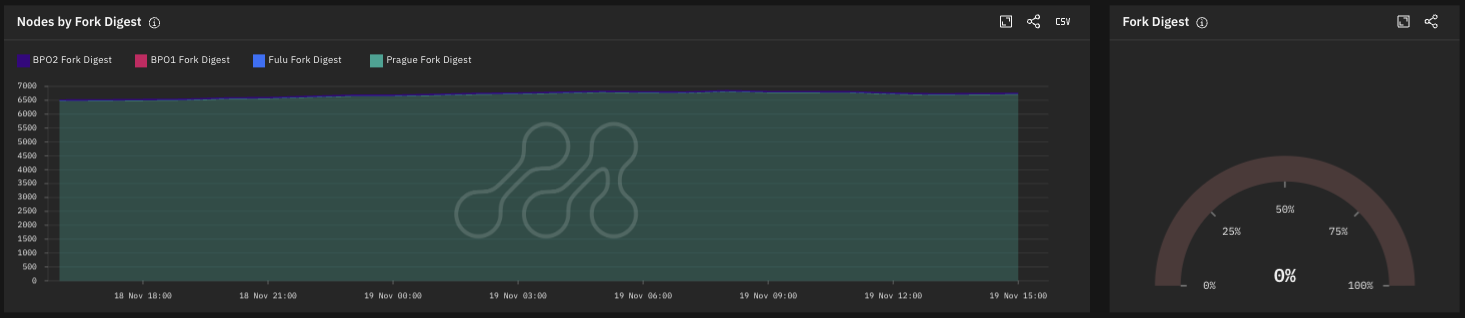

Metrika tracks fork digest distribution, block proposal rates, attestation effectiveness, and finalization distance to detect consensus issues and chain splits.

Ethereum Fork Digest and Network Metrics Related to the Fusaka Upgrade Source: Metrika Platform (Time Zone UTC)

After each upgrade:

- If any, document anomalies for regulatory reporting and audit requirements

Metrika provides historical data on network performance, enabling institutions to identify exactly when issues occurred. Our compliance-ready reports document key KRI throughout the upgrade, and for any date range, ensuring institutions can demonstrate appropriate monitoring controls to auditors and regulators at any time. Additionally, continuous monitoring of blob utilization and fee trends helps assess whether the BPO capacity increases (December 9 and January 7) are delivering the expected L2 cost reductions and throughput improvements.

Ethereum Blob Gas Price, Usage, Fees, and Utilisation Metrics Source: Metrika Platform (Time Zone UTC)

What could go wrong

If the Fusaka upgrade encounters issues, network operations and institutional processes face significant risks, including:

- Transaction finality delays

- Halted deposits and withdrawals at major exchanges and custodians

- Failed settlement of time-sensitive transactions

- Balance discrepancies between on-chain data and internal records

Unlike standard Ethereum upgrades, Fusaka's three-phase structure creates compounded coordination risk across 35 days. Institutions should verify that node operators and infrastructure providers have upgraded to compatible clients and monitor finalization stability during each transition window.

Metrika’s Network Upgrade Performance Dashboard provides real-time monitoring of Ethereum network health, with alerts for critical key risk indicators during high-stakes transition periods such as this upgrade. Schedule a demo to see how Metrika integrates into your operational risk framework.

Photo by Zoltan Tasi on Unsplash