Media & Insights

Stay informed on our latest strategic partnerships, product developments, and industry insights shaping the future of digital asset risk management.

30 resources available

Ethereum’s Fusaka Upgrade and BPO1 Activation

Ethereum’s latest series of protocol upgrades continues to unfold smoothly, with the Fusaka hard fork activating on mainnet at epoch 411,392 (Dec 3, 2025) and the first Blob Parameter Only (BPO1) fork now following as scheduled (activated at epoch 412,672 on Dec 9, 2025).

The Fusaka Upgrade: Why Financial Institutions Should Pay Attention

As Ethereum prepares for the Fusaka upgrade, financial institutions should understand the impact of these significant changes before the upgrade and plan accordingly. The Fusaka upgrade aims to enhance Ethereum’s network performance and cost efficiency, but it could introduce operational risk if the upgrade doesn’t go as planned.

The Evolution and Assessment of Digital Asset Risks - Digital Assets Week London 2025

Jack Davies, Metrika Senior Blockchain Analyst, participated in "The Evolution and Assessment of Digital Asset Risks" panel on Oct 9 alongside Cristiano Ventricelli, Vice President of Digital Economy at Moody's Ratings, and Vincent Gusdorf, Associate Managing Director and Head of AI Analytics and Digital Finance Research at Moody's Ratings.

Post Mortem: How did the AWS Outage Impact Blockchain Network Operations?

On Monday, October 20, 2025, Amazon Web Services (AWS) experienced a partial service disruption that rippled across the Internet, temporarily degrading performance for infrastructure providers and blockchain networks.

Metrika Named to the 'Ones to Watch' List by Chartis RiskTech100® 2026

Metrika has been recognized in the Chartis RiskTech100 2026 rankings as a ‘One to Watch’ in the newly established Digital Asset Data and Risk Management category. This recognition highlights Metrika’s role in supporting operational resilience and risk oversight in the evolving digital asset ecosystem.

What happened On-chain on Crypto Black Friday

On Friday, October 10, major tariff news roiled global markets, triggering a broad risk-off move across equities and macro assets. In crypto, those macro headwinds likely accelerated forced deleveraging and exchange liquidations occurring in short bursts.

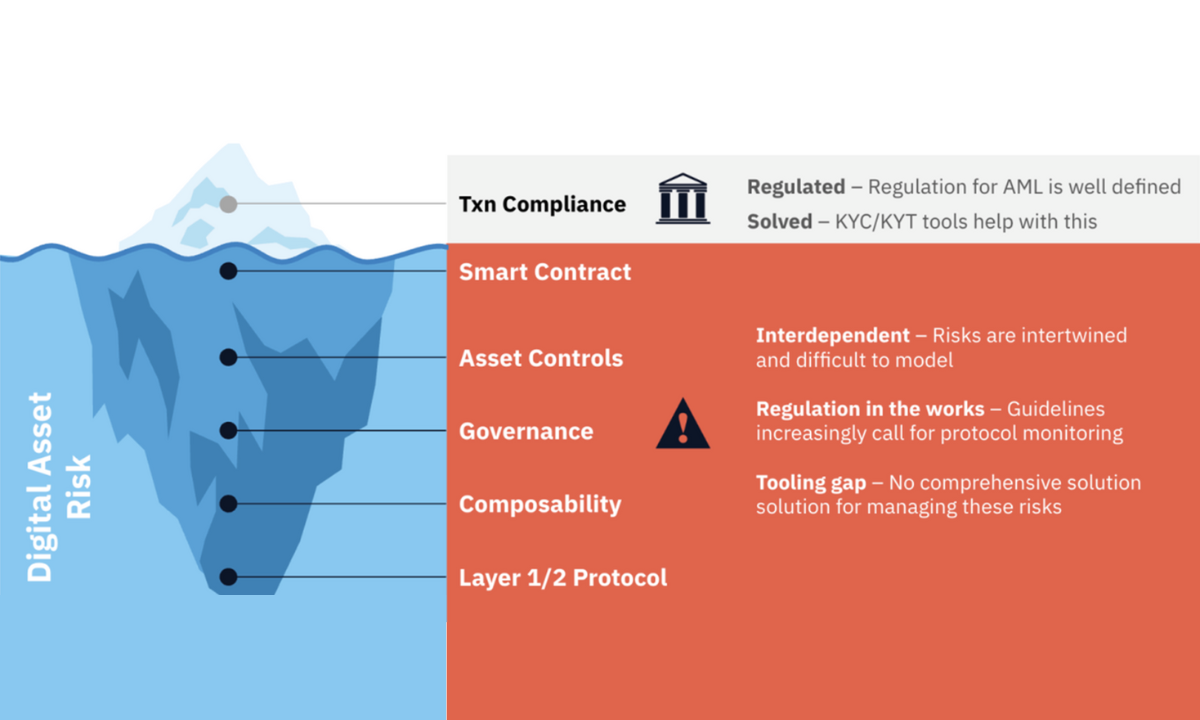

Chartis Research and Metrika Release Comprehensive Framework for Managing Digital Asset Risk

Chartis Research and Metrika today announced the release of a collaborative report titled "Managing Digital Asset Risk Using an Integrated, Composable Framework," establishing a new approach to quantifying and managing the unique risks inherent in digital assets and decentralized finance.

Metrika Joins Moody's Ratings at Digital Assets Week London 2025

On October 9, 2025, Jack Davies, Metrika's Senior Blockchain Analyst, joins Moody's Ratings experts in London for a discussion about the evolution and assessment of digital asset risks.

Metrika's Head of Analytics to Speak at TradFi Meets Blockchain Policy Summit in Washington DC

On October 8, 2025, Marianna Angelou, Metrika's Head of Analytics, joins industry leaders and policymakers in Washington, D.C. for a discussion about traditional finance and blockchain technology integration.

Metrika Sponsors the First-Ever Digital Assets Track at Risk Live North America 2025

The financial risk management landscape has reached a significant milestone. Risk Live North America has introduced its first dedicated digital assets track, with Metrika serving as the founding sponsor of this important industry development.

Post Mortem: What Happened on Polygon PoS on September 10, 2025

The Polygon PoS finality incident on September 10, 2025, created notable finalization delays of up to 1 hour and lasted around 12 hours. The event centred around a consensus milestone bug, which delayed transaction finality while block production continued.

Post Mortem: What Happened on Base on August 5, 2025

On August 5, 2025, the Base network experienced a sequencer incident that temporarily halted normal transaction processing for approximately 33 minutes.

Metrika Startup Spotlight at Consensus 2025

Metrika showcases innovative risk management solutions at Consensus 2025's premier startup spotlight session.

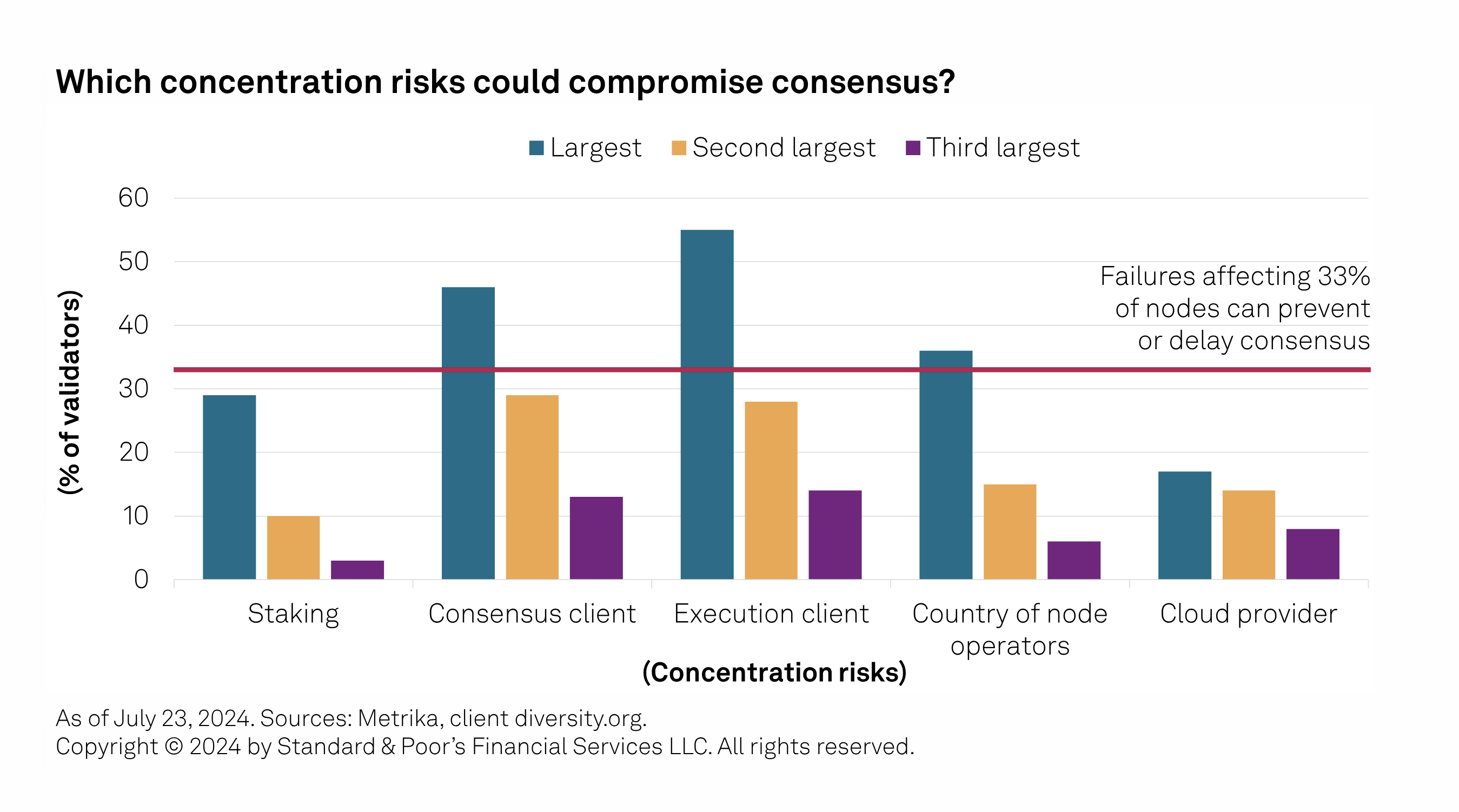

S&P Global Ratings Partnership on Multi-Chain Framework

S&P Global Ratings and Metrika conclude proof of concept for multi-chain digital asset risk framework, advancing institutional adoption.

Metrika Submission to SEC Crypto Task Force

Metrika's comprehensive submission to the SEC Crypto Task Force addressing regulatory frameworks for digital asset risk management.

Moody's Ratings Partnership on Operational Risk

Metrika successfully completes proof of concept with Moody's Ratings on evaluating operational risks in digital assets.

Metrika's 2024 Year in Review

Reflecting on Metrika's achievements, partnerships, product developments, and strategic milestones throughout 2024.

S&P Global References Metrika as Data Source

S&P Global Ratings highlights Metrika's role in understanding decentralization and Ethereum's network resilience.

Zodia Custody Partnership Announcement

Strategic partnership with Zodia Custody enhances digital asset risk management capabilities for institutional clients.

Institutional Interoperability in Multichain World

Joint research with Axelar exploring how financial institutions navigate complex multichain environments and interoperability challenges.

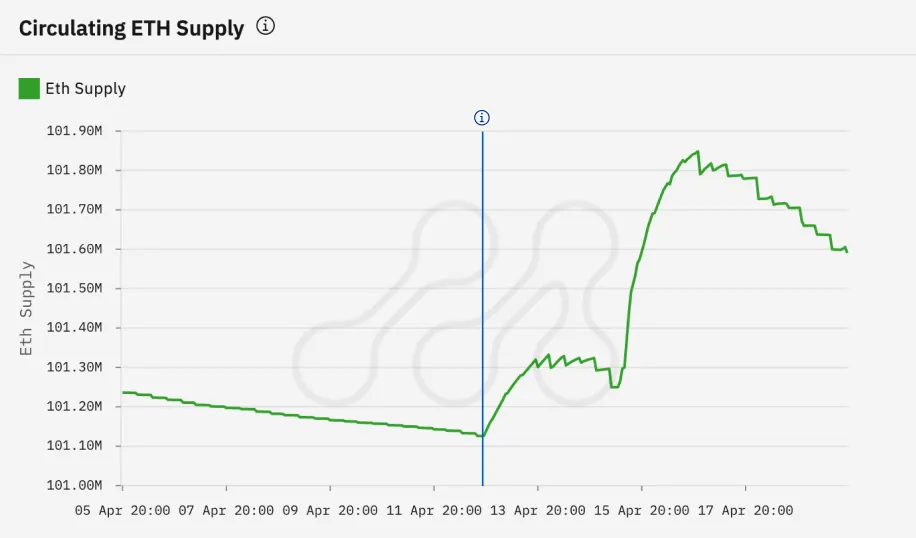

Recap of the Dencun Upgrade: A Smooth Transition and Evolving Landscape

Comprehensive analysis of Ethereum's Dencun upgrade impact on network performance and evolving blockchain landscape.

Empowering Trust: Network Health Monitoring

Joint white paper with EY exploring network health monitoring frameworks for public blockchain infrastructure.

Metrika's 2023 Year in Review

Comprehensive overview of Metrika's research contributions, partnerships, and technological advances throughout 2023.

Understanding Blockchain Protocol Risks

Academic paper published in Journal of Risk Management in Financial Institutions examining protocol-level risk factors.

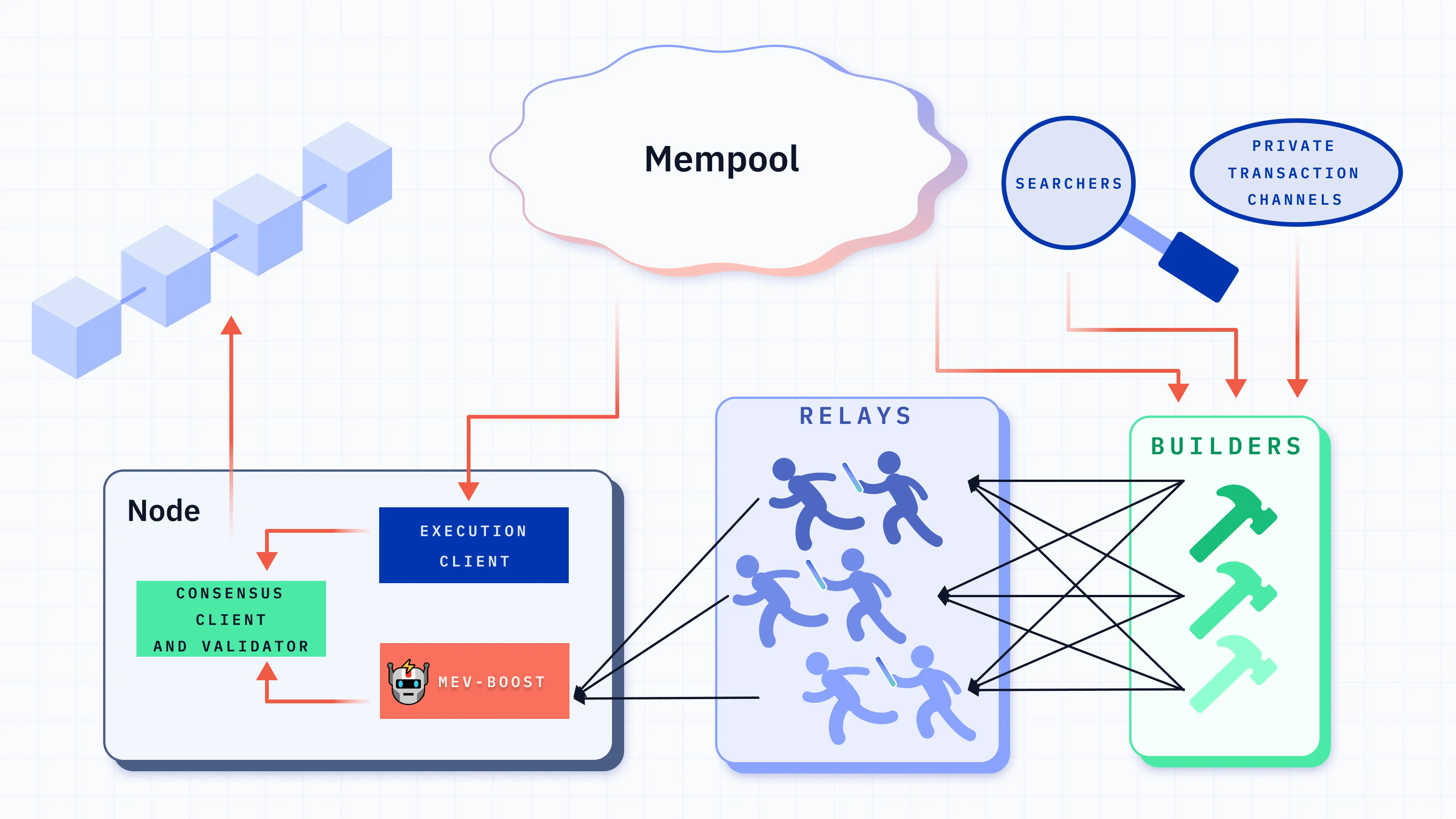

Staking 2.0 – Maximizing MEV Rewards

Alvaro Blazquez discusses advanced staking strategies and MEV optimization techniques at industry conference.

Stablecoin Risk Assessment Working Paper

Comprehensive analysis of stablecoin mechanisms, risks, and regulatory considerations for institutional adoption.

Ethereum Shapella Upgrade Recap

Detailed analysis of Ethereum's Shapella upgrade implementation and its impact on network staking dynamics.

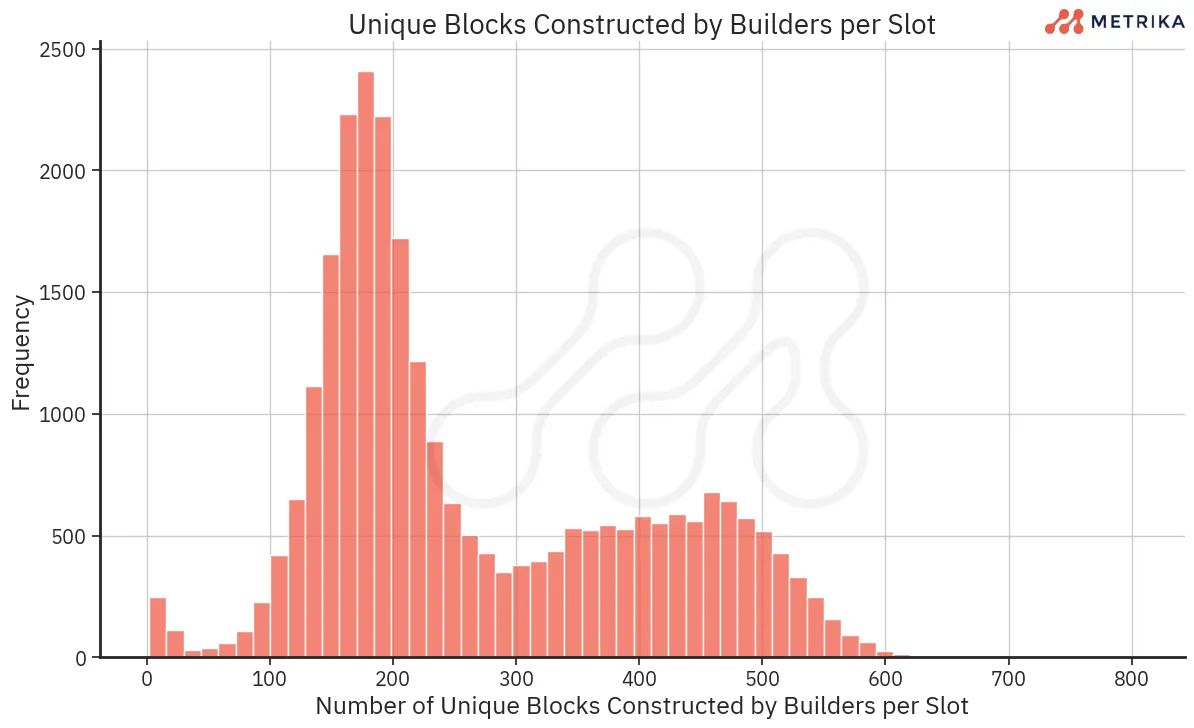

Relays Are a Latency Game

Technical deep-dive into MEV relay performance, latency optimization, and block building infrastructure dynamics.

Metrika's 2022 Year in Review

Year-end summary of Metrika's foundational research, early partnerships, and strategic developments in 2022.

Validators or Value-Takers?

Critical analysis of validator economics, MEV extraction, and the evolving dynamics of Ethereum's consensus mechanism.

Follow us on LinkedIn

Stay connected with Metrika's latest updates, insights, and industry engagement on LinkedIn.

Follow Metrika