What happened On-chain on Crypto Black Friday

On Friday, October 10, major tariff news roiled global markets, triggering a broad risk-off move across equities and macro assets. In crypto, those macro headwinds likely accelerated forced deleveraging and exchange liquidations occurring in short bursts.

Within hours, the activity spilled onto the Ethereum network, resulting in a sharp spike in transaction fees and corresponding finalization delays on multiple Layer-2 networks. While no major rollup experienced a full outage, several, including Base, Arbitrum, and Optimism, showed measurable degradation in their ability to post data and finalize on Ethereum.

The behavior of these networks demonstrates how macro-driven volatility can cascade through Ethereum’s scaling ecosystem, exposing the operational interdependence of Layer-2 rollups and the mainnet’s data-availability pipeline.

What Actually Happened

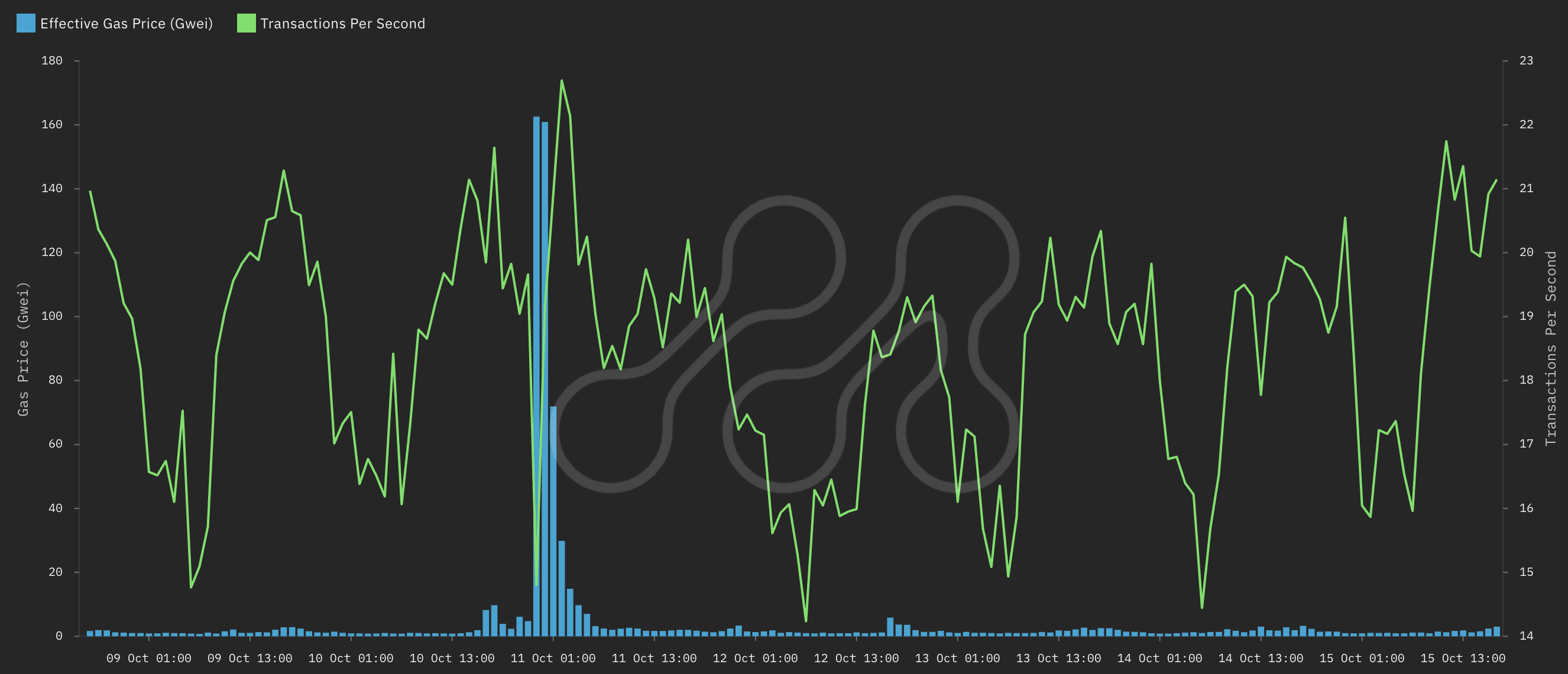

Between October 10, 18:00 UTC and October 11, 03:00 UTC, Ethereum’s transaction fees surged from baseline levels (<$1) to prices exceeding $100 on average, reflecting extreme congestion on L1.

Transaction Fees ($USD) Ethereum Mainnet Source: Metrika Platform (Time Zone UTC +1)

Average Effective Gas Price and Transactions per Second on Ethereum Mainnet Source: Metrika Platform (Time Zone UTC +1)

Although EIP-4844 introduced a separate blob-gas market, L2 sequencers still pay normal L1 gas for the transaction envelope that carries their blob commitments. When both markets rise together, the cost of posting L2 batches increases sharply, which can slow safe-head progression.

At the same time, Base’s own status page reported a “safe-head delay from high transaction volume.” The team stated that “heavy transaction volume on Base L2 [was] causing delays in batching data to Ethereum,” and that sequencing temporarily limited calldata inclusion to ensure the safe head could advance on L1.

When a rollup like Base or Optimism experiences a surge in user activity, the sequencer continues producing L2 blocks locally. But each block eventually needs to be anchored on Ethereum, a step that involves posting batch data (as calldata or blobs) to L1. During congestion, this anchoring becomes slower and more expensive. In other words, Base throttled to preserve settlement safety under a burst of internal traffic.

The L2 On-Chain Evidence

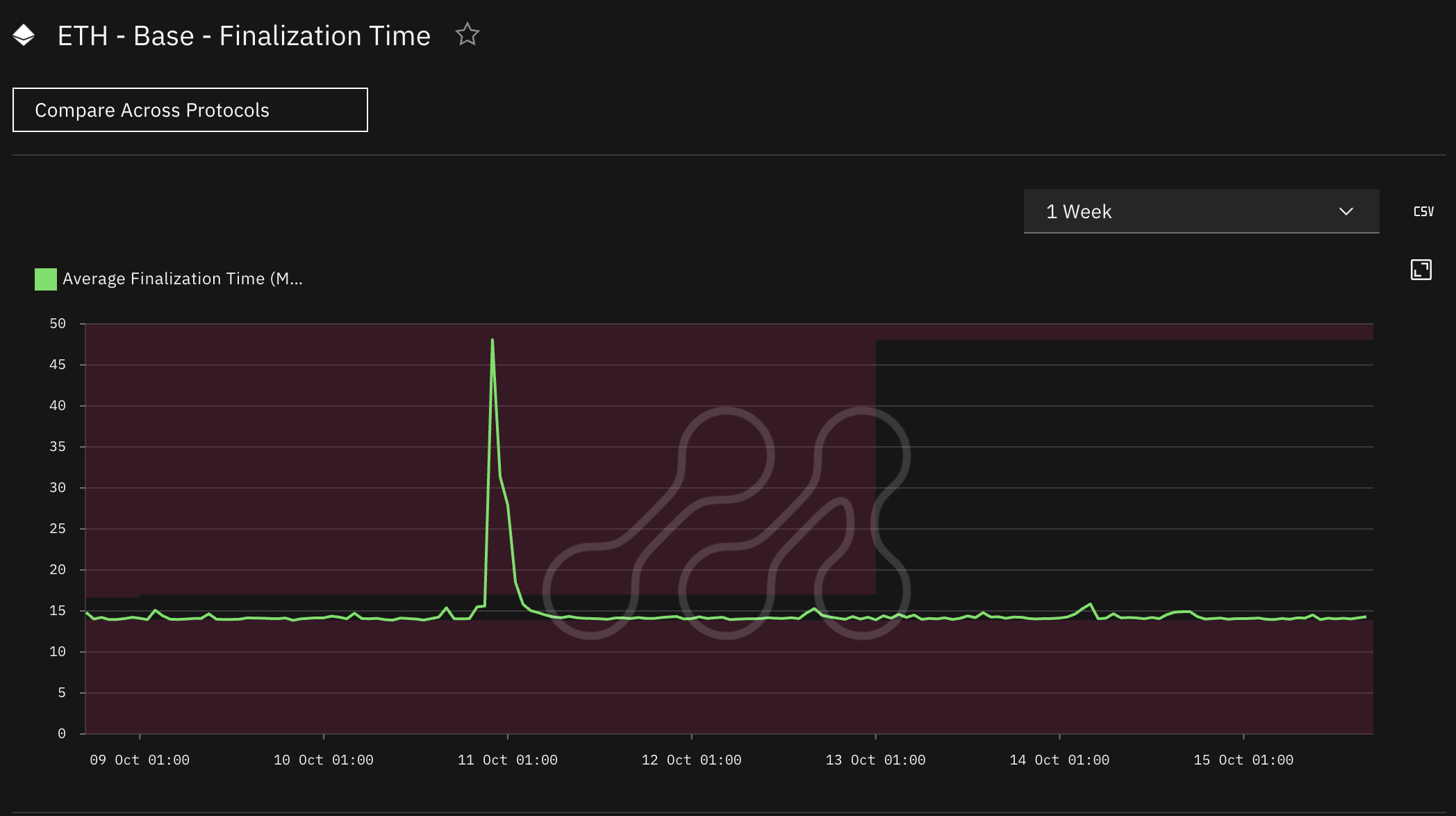

Base: Finalization times spiked from a stable ~14 minutes to 30–50 minutes during the fee surge window, consistent with the team’s public incident notes.

Optimism: Finalization latency increased from ~16 minutes to over 90 minutes, with visible “posting droughts” followed by bursty catch-ups, a clear sign of batcher throttling under L1 congestion.

Arbitrum: Showed similar peaks, with finalization stretching above 70 minutes before normalizing as Ethereum fees subsided.

Across all three, finalization-time spikes tightly correlate with L1 gas and blob-fee anomalies, suggesting that L1 congestion amplified each network’s internal load.

Finalization Time (minutes) on Arbitrum Source: Metrika Platform (Time Zone UTC +1)

Finalization Time (minutes) on Base Source: Metrika Platform (Time Zone UTC +1)

Finalization Time (minutes) on Optimism Source: Metrika Platform (Time Zone UTC +1)

Why It Happened

The incident was not a sequencer failure but a data-availability bottleneck propagated through the rollup stack.

- High L2 transaction volume (especially on Base) created large batches waiting to be posted.

- L1 congestion and fee spikes made posting those batches slower and more expensive.

- Sequencers throttled posting rates, deliberately, in Base’s case, to maintain safe-head progress.

- Result: Users experienced delayed finalization and higher latency, even as block production continued.

The episode shows how local throughput pressure and shared L1 dependencies can interact to create synchronized finalization delays across multiple rollups.

How Metrika Detected the Real Impact

Metrika’s observability data surfaced the episode across three key metrics:

- Finalization Time: 3–6× baseline delays on all three networks.

- Blob Posting Frequency: clear multi-hour droughts followed by catch-up bursts.

- Correlation with L1 Fees: near-perfect temporal alignment with Ethereum basefee spikes.

The Risk Monitoring Lesson for Financial Institutions

For traditional finance institutions integrating with rollups:

- Operational Controls ≠ Optional. Monitor KRIs such as finalization time or L1 transaction fees to trigger automated settlement-risk alerts.

- Finality ≠ Uptime. Networks can appear “healthy,” even while settlement reliability degrades.

- Shared Infrastructure Risk. All L2s ultimately depend on Ethereum’s data-availability pipeline.

So What? — The Institutional Takeaway

This episode highlights that macroeconomic shocks can propagate into on-chain settlement layers.

Even when L2 systems function as designed, their dependency on Ethereum’s data-availability channel introduces correlated operational risk.

For institutional participants, the key takeaway is to treat Ethereum fee spikes as settlement-risk events.

Integrating real-time finality and digital asset metrics into risk systems, alongside price and liquidity signals, allows for circuit-breaker-style responses during periods of elevated gas volatility.

Photo by Maxim Hopman on Unsplash