Ethereum’s Fusaka Upgrade and BPO1 Activation

Ethereum’s latest series of protocol upgrades continues to unfold smoothly, with the Fusaka hard fork activating on mainnet at epoch 411,392 (Dec 3, 2025) and the first Blob Parameter Only (BPO1) fork following as scheduled (activated at epoch 412,672 on Dec 9, 2025). Together, these steps mark a meaningful evolution in Ethereum’s scalability roadmap, and early network telemetry provides a clear view of how the ecosystem is absorbing these changes.

What Fusaka Introduced

Fusaka delivers several structural improvements aimed at long-term scalability and operational efficiency. Key changes include PeerDAS - an important step toward distributed data availability sampling, a 60M default gas limit, and a protocol-level cap on per-transaction gas usage. These are paired with a staged blob scaling process across BPO1 and BPO2, allowing the network to increase blob throughput without modifying unrelated consensus mechanisms.

For institutions evaluating Ethereum’s performance and broader roadmap, the significance is straightforward: Fusaka restructures the cost and capacity profile of the chain in a way that strengthens settlement reliability and supports increasingly data-intensive applications.

For more information about the Fusaka upgrade, read our previous blog post here.

Post Fork Dynamics, Understanding the Temporary Dip

Node coordination ahead of Fusaka was strong, with compatible client version adoption climbing rapidly and consistently across the network. By activation, the majority of nodes had converged on the new fork digest version, confirming that client configurations, operator coordination, and release readiness were aligned.

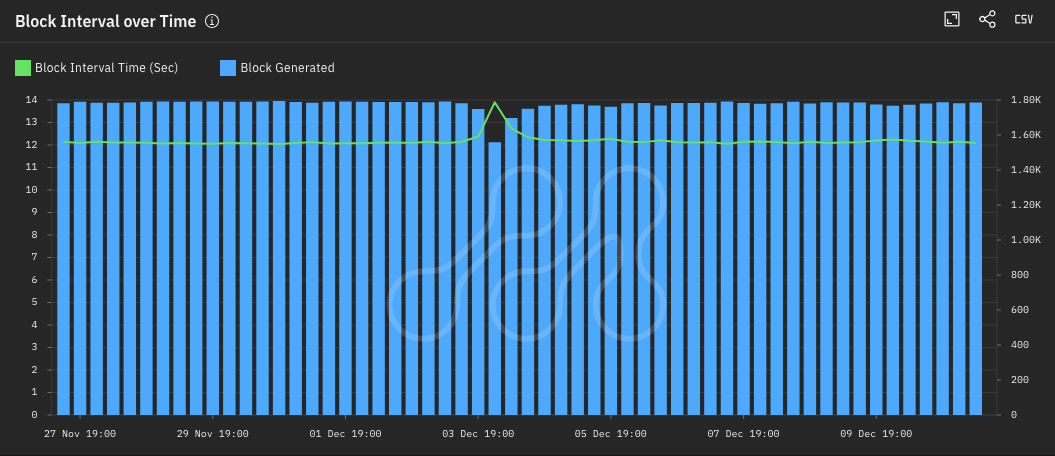

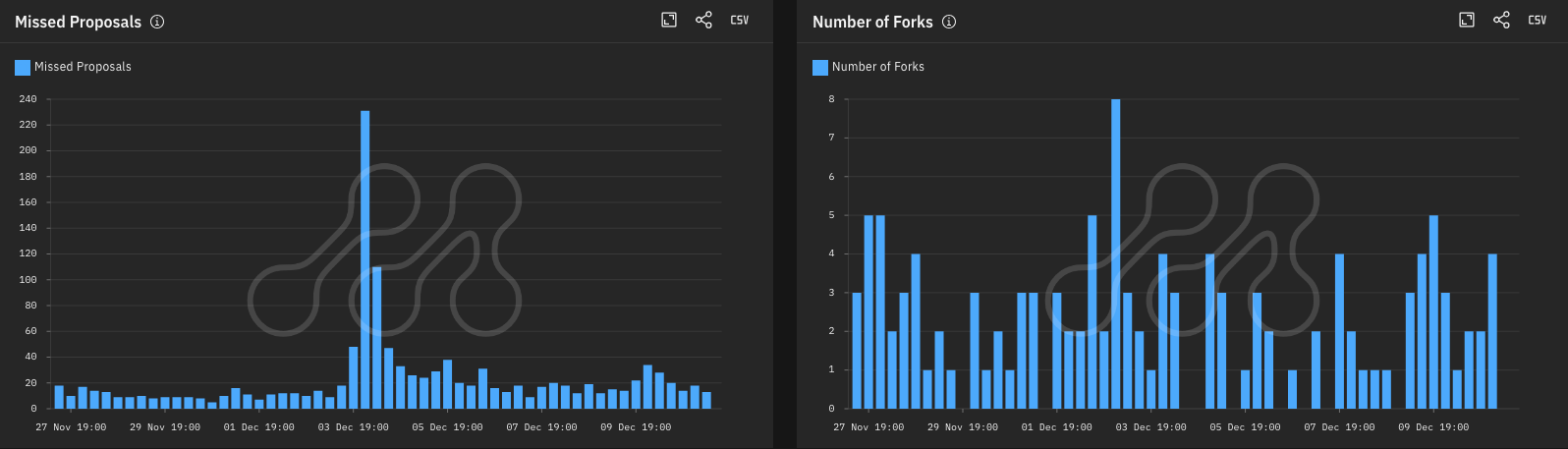

Immediately after Fusaka activated, Metrika’s network upgrade dashboard captured a short-lived performance wobble. The block proposal rate briefly dipped to around 67%, participation rate to roughly 75%, and attestation distance rose, indicating that some validators were attesting later than usual. Despite these conditions, finality remained stable, with finalization distance holding at 2 and only briefly reaching 3.

Source: Metrika Platform

The timing aligns with a publicly reported issue affecting the Prysm consensus client. As Prysm’s share of active validators is about 20%, the network exhibited characteristics typical of correlated client disruptions, increased missed proposals, and extended block intervals. Once operators patched or switched clients, performance metrics normalized quickly.

Source: Metrika Platform (Time Zone UTC)

For institutions, this reinforces a core resilience feature: client diversity ensures that no single implementation issue can compromise Ethereum's settlement guarantees.

BPO1 Activation, A Stable Continuation

With BPO1 activated at epoch 412,672 (Dec 9, 2025), the latest dashboard shows a markedly smoother transition than the mainnet fork. The participation rate has been consistently near 99% with only a brief and contained dip to ~91% near the activation epoch. Block proposals remained near historical baselines, attestation distance fluctuated within normal bounds, and finality continued uninterrupted at 2 epochs. Fork digest adoption rose smoothly above 95% shortly after activation.

The outcome validates the BPO approach, where blob-related parameters are updated without introducing changes to consensus or execution logic.

Source: Metrika Platform

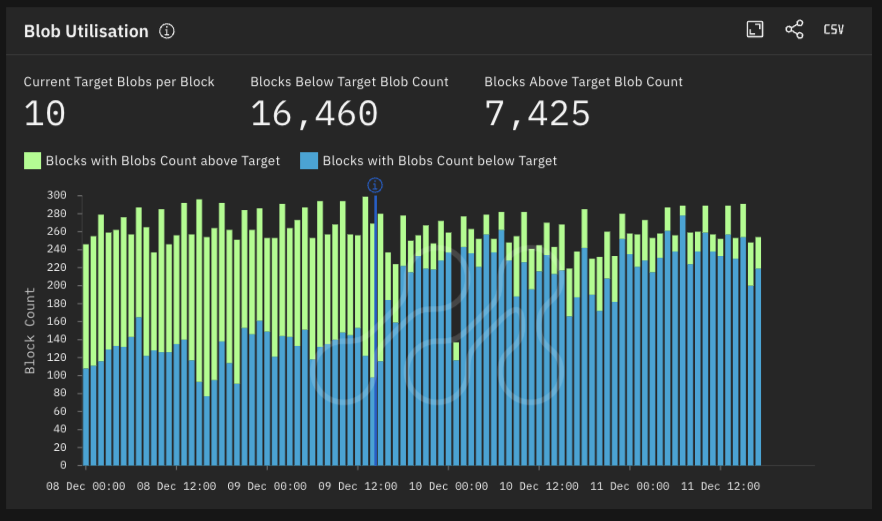

Blob Utilization After BPO1, Demand Absorbed Without Instability

Post-BPO1, blob utilization confirms the market is actively using the expanded capacity. The network now targets 10 blobs per block (up from 6), with a max of 15. Most blocks now sit at or below this new target, showing that the network has absorbed demand while preserving spare capacity. This pattern indicates Ethereum can scale blobs further without persistent congestion or underutilization.

Source: Metrika Platform (Time Zone UTC)

For institutions, this is a positive signal: the network is beginning to use expanded throughput, and it is doing so without compromising network reliability.

What This Means for Institutions

The Fusaka-to-BPO sequence illustrates a staged, observable, and resilient upgrade process that is resistant to localized client issues. For institutions that rely on Ethereum for settlement, collateralization, tokenization, or on-chain market infrastructure, early results point to several key takeaways:

- Operational Stability: Even under client-specific disruptions, finality and settlement guarantees were maintained.

- Predictable Scaling: Blob capacity is increasing in measured steps that are easy to monitor.

- Protocol-level Safeguards: Parameters such as the transaction gas cap and execution cost boundaries help mitigate risk during periods of high demand.

- A Maturing Upgrade Lifecycle: The seamless, synchronized adoption of fork digests across consecutive upgrades confirms that Ethereum has evolved into a predictable and robust operation, one that demands continuous verification to ensure settlement guarantees remain intact.

As Ethereum progresses along the BPO and PeerDAS roadmap, operational resilience must be observed, not assumed. Metrika will continue to monitor validator behavior, consensus health, and post-upgrade performance, providing the risk clarity institutions require to navigate this evolving public blockchain infrastructure with confidence.

Photo by Nenad Novaković on Unsplash