Metrika’s 2025 Year in Review

Redefining Institutional Risk for the Digital Asset Era

For the digital asset industry, 2025 was the year sophisticated risk management transitioned from "nice to have" to "non-negotiable" for institutional participation. At Metrika, we spent the last 12 months building the connective tissue between blockchain networks and the rigorous standards of global finance.

From multi-chain proof-of-concepts with the world's leading credit rating agencies to direct engagement with federal policymakers, here's how Metrika helped redefine what institutional-grade digital asset risk management looks like.

Q1: Building the Institutional Bridge

The year began with technical validation: demonstrating that blockchain risks can be quantified within traditional risk frameworks.

Moody’s Ratings PoC (March)

We collaborated with Moody's Ratings to prove how digital asset risks (network health, governance dynamics, protocol security) can be systematically measured and integrated into credit assessment models that institutions already trust.

“As tokenization gains momentum across industries, institutions need to be able to identify and manage potential operational vulnerabilities in digital finance effectively” said Rajeev Bamra, Head of Strategy, Digital Economy at Moody's Ratings. "The collaboration with Metrika allowed us to explore how digital finance risks can be systematically measured, ensuring transparency and data-driven insights as digital assets become more integrated into mainstream economy.”

Source: Press Release on Business Insider (Metrika Successfully Completes Proof-of-Concept on Evaluating Operational Risks in Digital Assets, March 25, 2025)

Moody’s Ratings Digital Asset Bootcamp (London)

At Moody's London headquarters, we delivered educational sessions for senior analysts on tokenization's implications for traditional markets, demystifying DeFi mechanics and smart contract risk.

Source: Cristiano Ventricelli (VP - Decentralized Finance & Digital Assets, Moody's Ratings) on LinkedIn

Q2: Scaling Validation and Global Policy

As tokenization momentum built, we expanded our platform to handle the complexity institutions actually face: fragmented, multi-chain environments where assets move seamlessly but risks compound silently.

S&P Global Ratings PoC (May)

In our most ambitious technical milestone of the year, we concluded a proof-of-concept with S&P Global Ratings implementing real-time monitoring across five EVM and non-EVM blockchains. The project established over 100 Key Risk Indicators and 10 dynamic, live risk assessments specifically calibrated for tokenized money market funds, proving enterprise-grade monitoring can scale across different blockchain architectures.

Source: Press Release on Business Insider (Metrika and S&P Global Ratings Conclude Proof-of-Concept for Multi-Chain Digital Asset Risk Framework, May 14, 2025)

Industry Engagement:

SEC Crypto Task Force

We submitted formal input on operational risk considerations for digital asset innovation, advocating for real-time monitoring as a baseline requirement.

Point Zero Forum (Zurich)

CEO Nikos Andrikogiannopoulos discussed how direct regulatory-industrial dialogue in the U.S. is creating conditions for safe innovation.

Source: Nikos Andrikogiannopoulos (Founder & CEO, Metrika) on LinkedIn

Consensus 2025 (Toronto)

Watch Nikos presenting at the Startup Village at Consensus 2025, demonstrating how Metrika enables organizations to monitor, assess, and mitigate risk in real time across network health, compliance, and operational resilience.

Source: Nikos Andrikogiannopoulos (Founder & CEO, Metrika) on LinkedIn

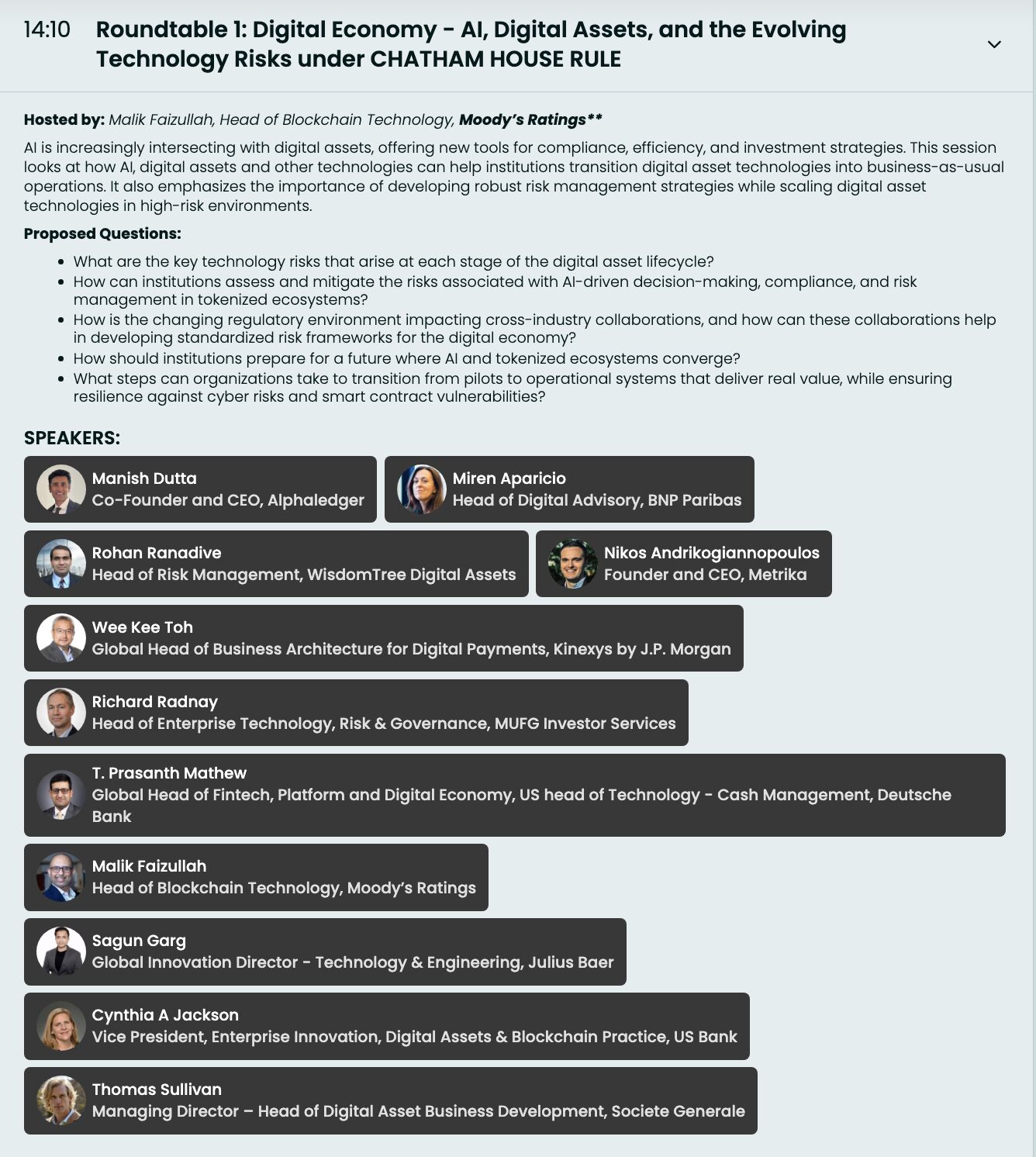

Digital Assets Week at Moody's Ratings (New York)

We joined a powerhouse roundtable on "Digital Economy: AI, Digital Assets, and the Evolving Technology Risks" under Chatham House Rule. The closed-door session brought together leaders from banks, fintechs, asset managers, and infrastructure providers to discuss the convergence of digital assets and AI, and the operational, regulatory, and reputational risks that come with it.

Source: Metrika on LinkedIn

Q3: Aligning with Regulatory Momentum

The summer brought the regulatory clarity the industry had been anticipating, and Metrika positioned itself at the center of translating policy into operational reality.

Policy Engagement in Washington DC

Our team met directly with the SEC Crypto Task Force and engaged with policymakers on the Senate Committee on Banking, Housing, and Urban Affairs and the House Committee on Financial Services.

The message was consistent: continuous monitoring of financial, technical, and governance risks isn't optional. It's the foundation for safe institutional adoption of blockchain-based assets.

Source: Metrika on LinkedIn

These conversations demonstrated that regulators increasingly understand what we've been building: the infrastructure layer that makes tokenized finance auditable, transparent, and compatible with existing compliance frameworks.

Q4: Operationalizing Risk Intelligence

The final quarter was defined by framework launches, industry recognition, and real-world validation of our monitoring capabilities during critical network events.

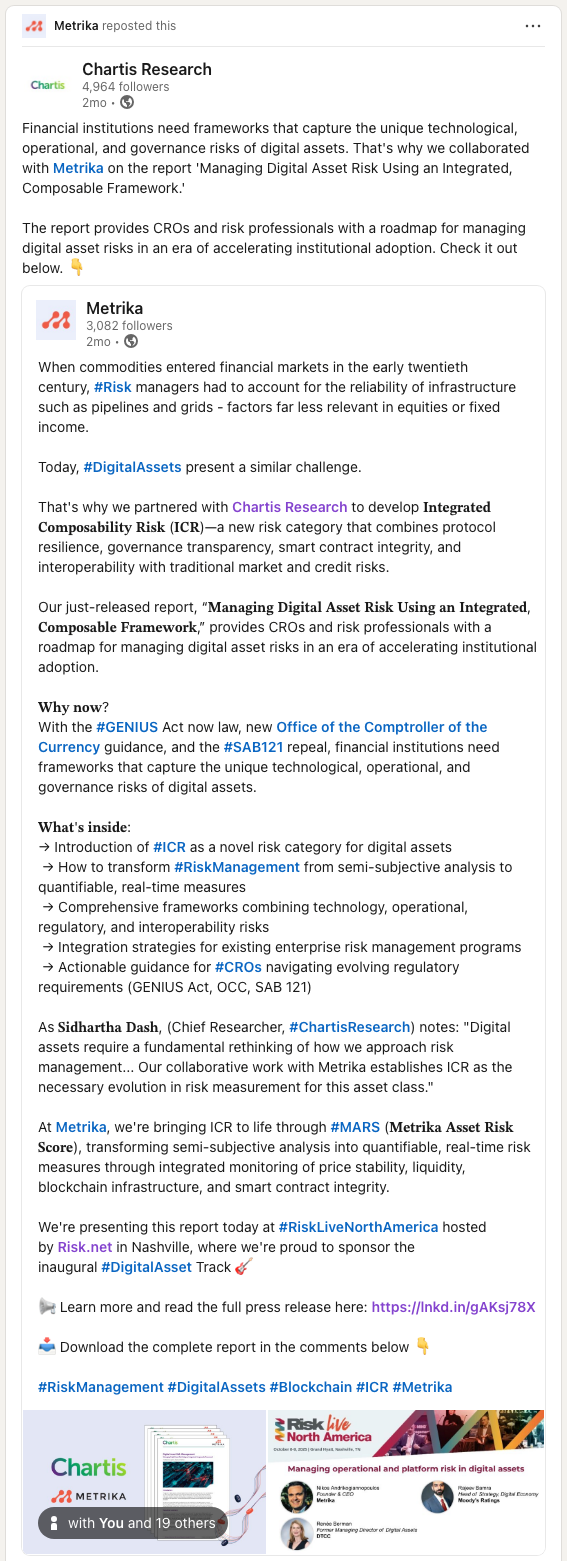

Introducing ICR and MARS (October):

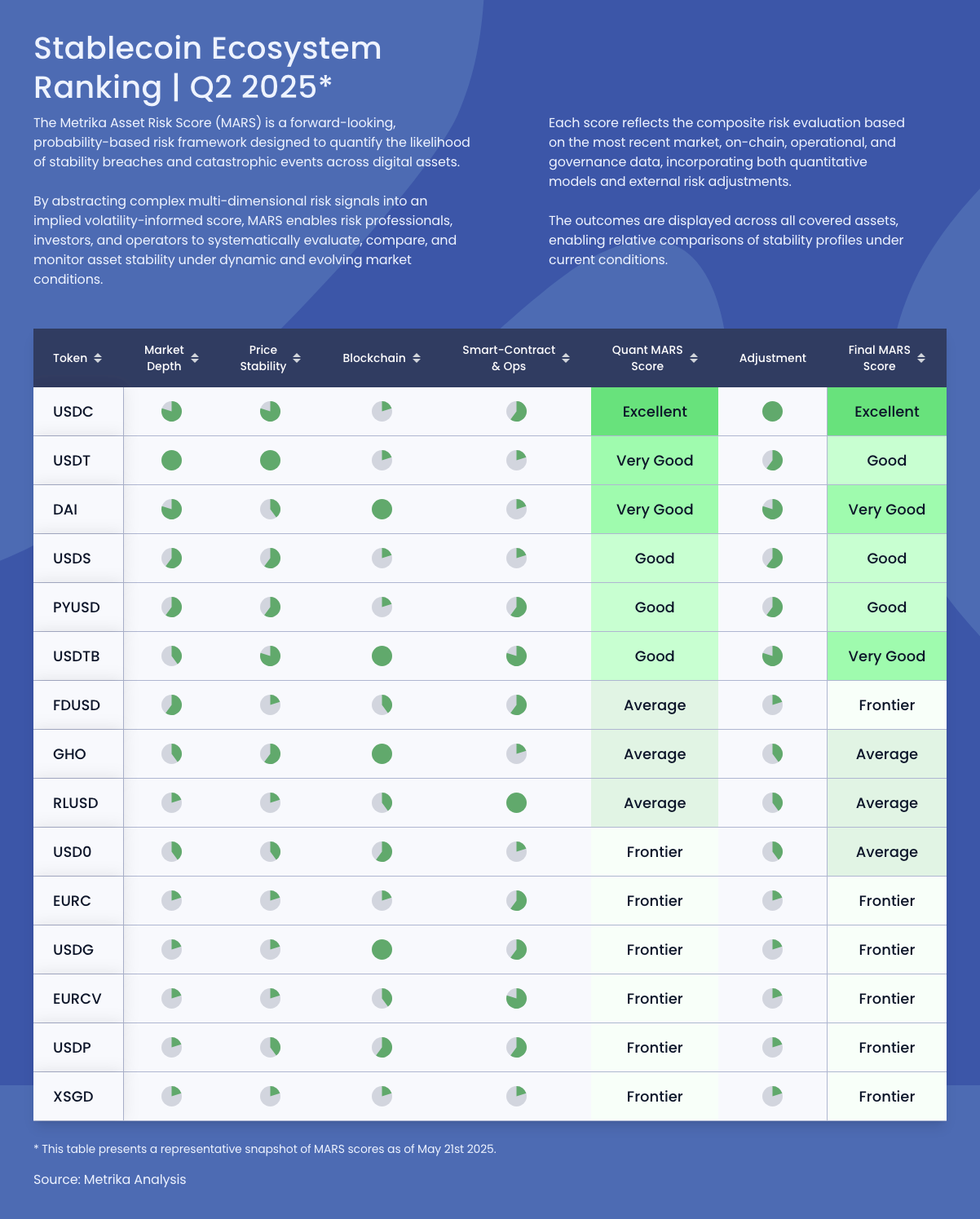

Collaborating with Chartis Research, we released the Integrated Composability Risk (ICR) framework, the first systematic approach to quantifying DeFi's interconnected dependencies. We operationalized this through the Metrika Asset Risk Score (MARS), a real-time scoring engine that gives institutions a single, actionable metric for digital asset stability across protocol, asset, and network layers.

Source: Chartis Research on LinkedIn

Source: Metrika Asset Risk Score (MARS)

Real-Time Risk Detection When Markets Need It Most

Throughout 2025, our platform served as the critical observability layer during major network incidents, proving that institutional-grade risk monitoring isn't just about collecting data, but correctly interpreting what it means for operational exposure in real time.

We published detailed case studies analyzing:

- Base Sequencer Incident (August): While the official status reported "halted block production," our platform correctly identified technical uptime but confirmed that blocks were empty of user transactions. We clarified the "unsafe-head delay" as a failsafe mechanism rather than a complete chain failure.

- Polygon Finality Bug (September): We captured a spike in finalization time to nearly 1 hour (from typical seconds) and a doubling of block intervals. This incident originated from a faulty milestone proposal that disrupted security checkpoints.

- AWS DNS Outage (October): We mapped a DNS failure in the AWS us-east-1 region that directly impacted Base infrastructure. Metrics showed block space utilization dropping to ~16%, finalization time spiking to 78 minutes, and a 40% fall in transactions per second (TPS).

- Crypto Black Friday (October): We tracked macroeconomic shocks from tariff news that surged Ethereum mainnet fees above $100. This caused synchronized delays on Base (30–50 min), Optimism (90+ min), and Arbitrum (70+ min) as L2 networks throttled batch posting to Ethereum.

Each incident validated a fundamental truth: in digital asset markets operating 24/7/365, the difference between accurate real-time intelligence and delayed interpretation can mean the difference between informed risk management and institutional exposure.

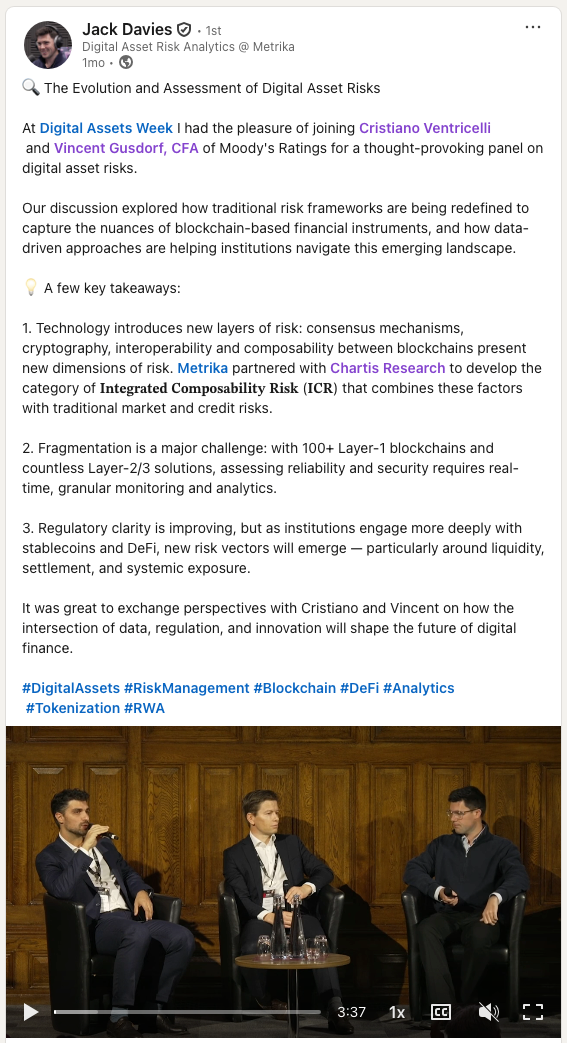

Digital Assets Week (London)

Senior Blockchain Analyst Jack Davies joined experts from Moody's Ratings in a panel discussion on the evolution and assessment of digital asset risks, reflecting how Metrika's voice has become integral to institutional-grade conversations.

Watch the full panel discussion here.

Source: Jack Davies (Senior Blockchain Analyst, Metrika) on LinkedIn

Industry Recognition: Chartis RiskTech100® 2026

Metrika was named as a 'One to Watch' in the inaugural Digital Asset Data and Risk Management category of the Chartis RiskTech100® 2026. This validation confirms that our approach to composability risk and real-time monitoring is defining a new category of enterprise infrastructure.

Source: Metrika Named to the 'Ones to Watch' List by Chartis RiskTech100® 2026

The 2025 Conference Circuit

We contributed expertise across academic, regulatory, and industry forums throughout the year, with a landmark moment coming in October when we served as the Founding Sponsor of the Digital Assets Track at Risk Live North America held in Nashville.

Source: Metrika on LinkedIn

(From L-R): Renée Berman, former Managing Director of Digital Assets at The Depository Trust & Clearing Corporation (DTCC); Nikos Andrikogiannopoulos, Founder and CEO, Metrika; Rajeev Bamra, Head of Strategy for Digital Economy at Moody's Ratings, at Risk Live North America 2025.

Additional 2025 engagements included:

- Digital Assets at Duke University

- Panathēnea (Athens)

- Digital Assets Summit (DAS) New York

- DC Blockchain Summit

- GARP Financial Risk Symposium (New York)

- GARP Chapter Meeting: Evolution of Digital Assets & Risk Management Practices (New York)

- TokenizeThis (New York)

- TradFi Meets Blockchain Policy Summit in Washington DC

- Hacken Blockchain Security & Compliance Trust Summit (New York)

(From L-R): Sal Ternullo (A100x Ventures), Rajeev Bamra (Moody's Ratings), Nikos Andrikogiannopoulos (Metrika), Chaddy Huussin (JPMorganChase), and Ryan Rugg (Citi), at Hacken Blockchain Security & Compliance Trust Summit (New York).

Looking Ahead to 2026

As 2025 closes, Ethereum is executing its most ambitious upgrade sequence yet with Fusaka. The multi-phase rollout, including the December 3rd mainnet hard fork and subsequent BPO1 activation, represents a fundamental restructuring of network cost and capacity. Our real-time telemetry tracked this transition closely, including a brief Prysm client disruption and successful BPO1 deployment.

Early results show Ethereum successfully absorbing expanded blob capacity, targeting 10 blobs per block up from 6. This observed resilience confirms that institutional-grade settlement infrastructure is maturing at the exact moment tokenization requires it.

What's Next for Metrika in 2026:

- Expanded Coverage and Platform Features: We will provide deeper monitoring and launch new platform features to support institutions as they integrate blockchain into core operations.

- New Partnerships: Look for announcements regarding new collaborations with financial institutions, infrastructure providers, and industry groups as we work to standardize digital asset risk metrics.

- Technical Insights: We will continue publishing real-time risk case studies and deepening our engagement with academic, regulatory, and industry forums.

The roadmap ahead is clear: institutional adoption requires real-time verification and infrastructure-grade certainty. We look forward to being your partner in that journey.